Italy’s sports betting industry recorded a robust start to the year, with both the online and retail segments reporting significant year-on-year increases in gross gaming revenue (GGR) for January 2026.

Online betting: GGR up 28.8% year-on-year

The online sports betting segment generated €204.8 million in GGR, up 28.8% compared with €159 million in January 2025.

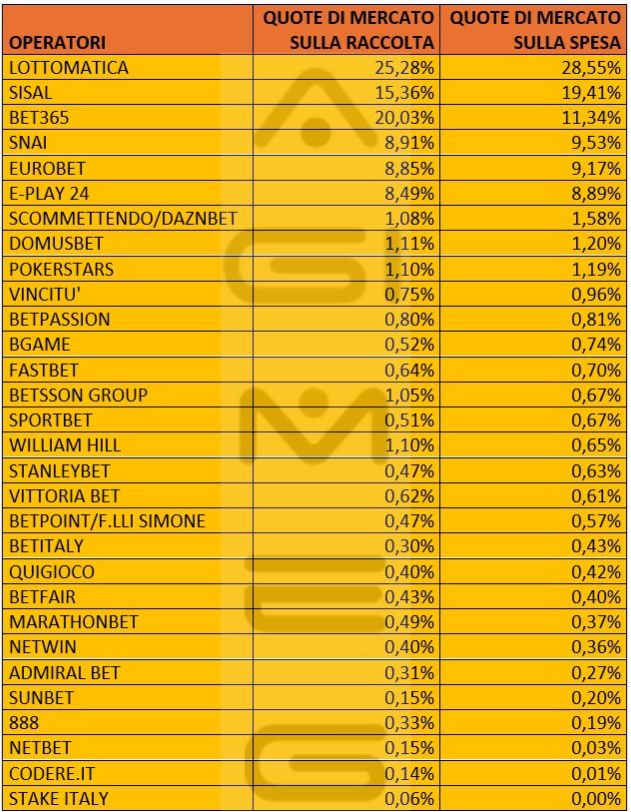

Turnover also increased, reaching approximately €1.5 billion, a 7.1% rise from €1.4 billion twelve months earlier.

Lottomatica confirmed its leadership position in the online market with a 28.6% GGR market share. Sisal followed in second place with 19.4%, recording double-digit growth (+14%).

Among the operators posting notable performances were E-Play24 (+17.6%, close to 9% market share), Scommettendo/DaznBet (+47.7%), Domusbet (+76.5%), Vincitù (+21.5%), Stanleybet (+6.8%), Sportbet (+52.3%), Betsson Group (+71.8%), AdmiralBet (+3.8%), Fastbet (+34.6%) and PokerStars (+33.7%).

A particularly sharp increase was reported by Netwin, which recorded growth of over 300% compared with January 2025. The figures confirm the continued expansion of Italy’s online betting segment under the current regulated framework.

Retail betting: GGR up 26.3%

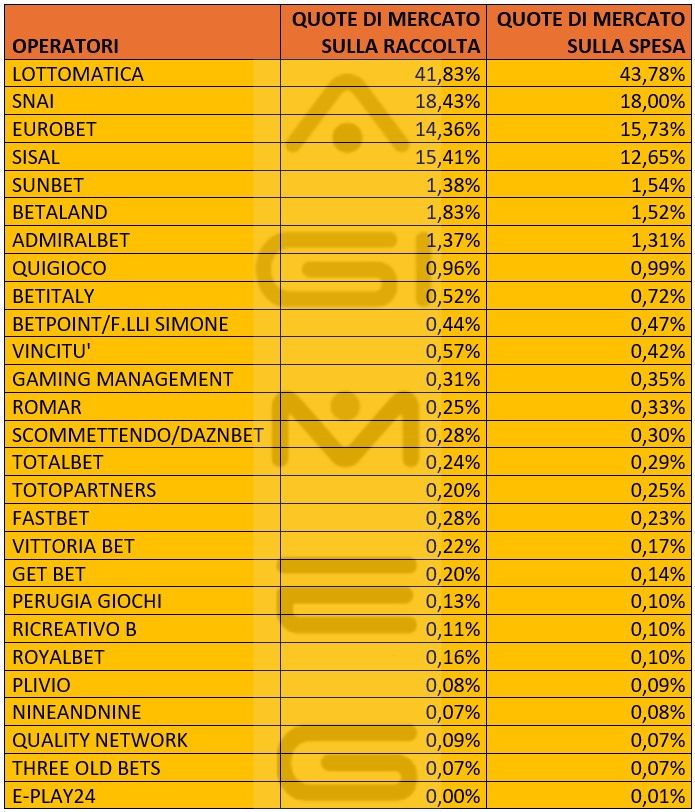

Growth was equally strong in the land-based channel. Retail sports betting GGR rose from €99 million in January 2025 to €125 million in January 2026, representing a 26.3% increase.

Turnover climbed from €499 million to €564.2 million, up 13.1% year-on-year.

In the retail segment, Lottomatica retained its leadership position, posting a 2.2% increase in market share. Snaitech and Eurobet completed the top three, with Eurobet reporting a 1.4% rise.

Other operators delivering positive performances included Betaland (+1.3%), Sunbet (+10%), AdmiralBet (+9.2%), Quigioco (+28.6%), Vincitù (+61.5%) and Betitaly (+16.1%).

The January data underline a broadly positive start to 2026 for Italy’s regulated sports betting market across both distribution channels.

Complete market share data for all licensed online operators

Complete market share data for all licensed retail operators

sb/AGIMEG